Reverse mortgages have been growing in popularity in recent years at a substantial rate. With home equity reaching all-time highs and baby boomers now entering retirement, more individuals have been electing for a reverse mortgage. Reverse mortgages have a stigma of being expensive and cumbersome, however, they do not need to be.

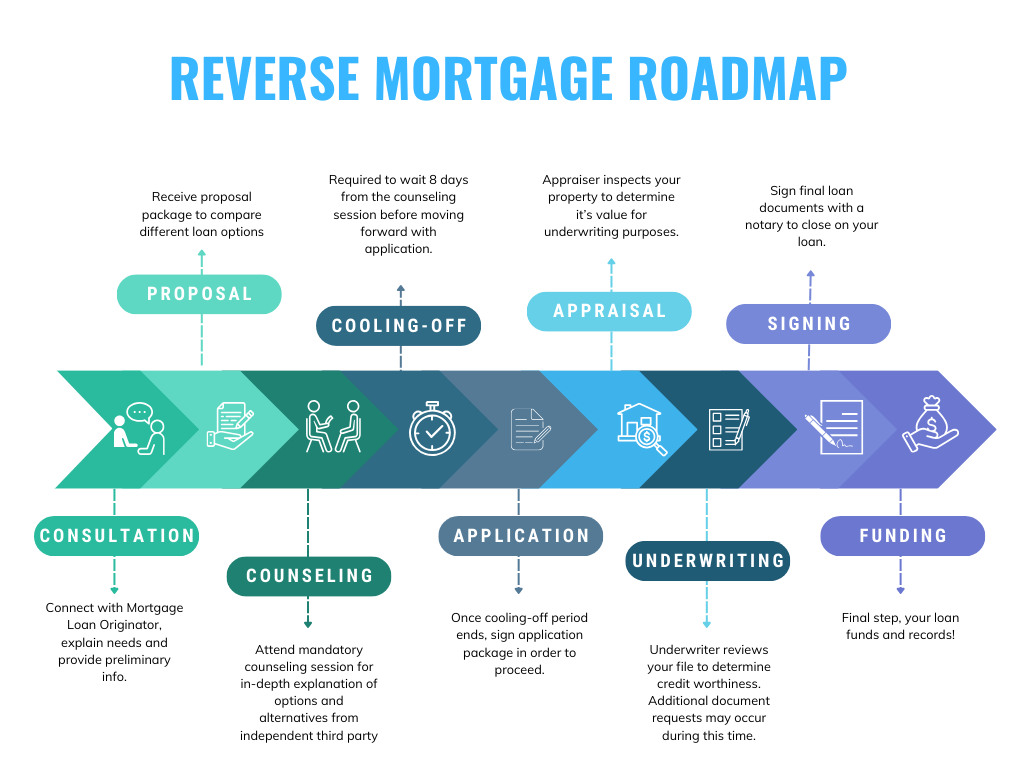

In order to determine if a reverse mortgage is right for you and what you can expect the process to look like, check out the steps below.

Step 1 Initial Consultation

The first step in any mortgage application is to connect with a Bluefire mortgage loan originator. During this initial phone call, you will want to be able to describe your needs (what you are looking for) and provide some necessary information (Date of Birth, Home Address, Current Estimate Home Value, Current Liens Property, etc.).

Step 2 Proposal

Once you have provided your Bluefire mortgage professional with all the information they need, allow them some time to search for the best specific loan product available for your given scenario. They will then create a proposal package where you can compare the different loan options available as well as a complete breakdown of all of the information pertaining to a reverse mortgage.

Step 3 Counseling Session

Now that you have decided to move forward with one of the options your mortgage professional provided you with, the next step is to attend a mandatory counseling session.

In California, this counseling session can be completed via telephone or in person. It typically takes one hour and you will obtain a counseling certificate at the end of the session. The counseling session will cover the homeowner’s financial needs and situation, the different loan options including their implications and costs, potential risks associated with the loan, and when the loan must be repaid by you or your heirs. The counselor will also help you explore alternative options such as government assistance, downsizing, or other financing options.

Step 4 Cooling-Off Period

In California, it is required to wait 8 days from the counseling certificate until moving forward to the actual application. This is required by law in order to ensure that the borrower has had enough time to ensure they want to proceed with a reverse mortgage product.

Step 5 Application

Once the cool-off period ends, your mortgage professional will create and share an application package to review with you. You will need to sign the application in order to proceed. At the same time, you will also need to provide documentation (Driver License, Social Security Card, Mortgage Statement, Income Documentation, etc.) to go along with your application.

Step 6 Appraisal

An appraisal will be required on your property. The Bluefire mortgage professional will order the appraisal and an appraiser will reach out to you to schedule a time for the property inspection to take place. This appraisal will determine the property value underwriting will use and ensure that your property is up to code per FHA guidelines. If the appraisal indicates any issues with the property these will need to be resolved before closing.

Step 7 Underwriting

During this phase of the process keep your eye out for any communication from your Bluefire mortgage professional. It is possible that you will need to provide more information or documentation while the loan is in the process of being approved.

Step 8 Signing

Once your loan has been approved and is cleared to close the next step in the process is to complete a final loan signing. California requires that all residential loan signings take place in person with a licensed notary. This notary can be dispatched to your residence for convenience.

Step 9 Loan Funding

During this final step, your reverse mortgage loan will be ready to fund, close and record at which point your proceeds will be made available to you.

If you have any questions, feel free to reach out to discuss with one of our Mortgage Loan Originators at (760) 930-0569.