It’s no surprise that real estate prices have been soaring this past year. The allure of homebuying was beckoned by declining rates and the shift in housing patterns COVID-19 brought. As the need for space coupled with the absence of commuting grew, certain cities became more popular than others.

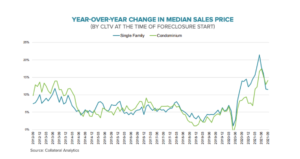

However, for the first time in 15 months, the rate of acceleration in home price growth actually declined from 19.4% to 19.0% in August. Real estate analysts predict that this may be indicative of a broader downshift in the housing market in the year ahead. Even still, the home price growth for August is about twice the historical appreciation in comparison; home prices around the nation have climbed at a rate of 10% annually.

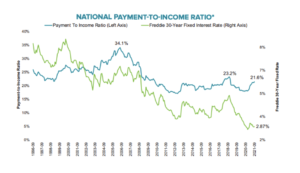

Affordability in the current market scape is of the biggest concern for potential homebuyers. The monthly payment required to purchase the average priced home with a 20% down, 30-year fixed-rate mortgage increased by more than 20% so far this year. This marks the highest average monthly mortgage payment since late 2007.

Currently, it takes approximately 21.6% of median household income to cover monthly mortgage payments, versus the previous payment-to-income ratio of 20.5%. Usually home price growth slows at this point, but the shortage of housing supply has elevated pricing, making affordable housing that much slimmer.

Although new listings grew in August by 4%, the total was still 9% fewer listings than the average number of the month in pre-pandemic years.

Although still historically low, they are projected to make a sharp rise while income remains the same, further stretching affordability boundaries.

One thing remains constant, and that is the increasing inventory in popular areas such as San Francisco, Sacramento, San Jose, Riverside, and Los Angeles counties, where inventory levels are ahead of pre-pandemic numbers.

If you have any questions regarding the direction of the housing market, please feel free to call us at (760) 930-0569 and one of our loan officers will assist you.