When qualifying for a residential mortgage, lenders are required to ensure that the borrower is able to repay the loan. The most important metric in determining this is the borrower’s income. While most loan programs make this determination by using the Debt-To-Income ratio there is another less-known method called Residual Income.

The most common loan program that uses a residual income calculation is for VA mortgage loans. VA loans are limited to US military veterans, active-duty military personnel, and surviving spouses who meet the eligibility requirements set forth by the Veterans Administration.

As outlined below, the residual income calculation for VA loans includes many factors that the traditional debt-to-income ratio does not. Please note that VA loans may have limitations with both debt-to-income and residual ratios.

How to calculate residual income

The first line item to figure out for residual income is your monthly gross pay. Once that is determined you then need to figure out what your total proposed monthly housing expense will be (PITI). After that, you must factor in your other monthly debts and obligations into the loan.

This includes debts reporting on your credit report, child care expenses, and other payment obligations. The next step is to factor in your estimated monthly maintenance and utilities which is currently determined by your proposed square footage (square foot X $0.14 currently).

Gross Monthly Income

-Monthly Property Expense (PITIA)

-Monthly Debt Obligations

-Monthly Utility/Maintenance

-Monthly Taxes

=Residual Income

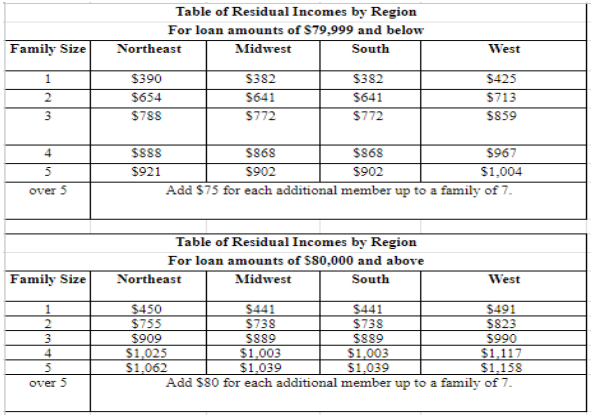

Once you have your residual income calculated you then need to compare it to the VA’s chart to determine if you meet the requirements. The chart takes into account your household family size and which region of the country you live in (Northeast, Midwest, South, West).

It is important to note that many lenders have overlays in addition to the minimum residual income requirements. While you might meet this threshold, it is possible you will not qualify if you do not meet all of these overlays.

If you have any further questions, please feel free to reach out to and discuss with one of our mortgage loan originators at (760)930-0569.